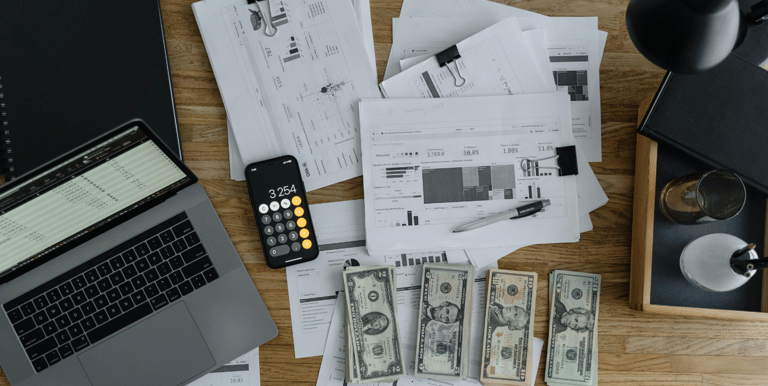

Catch-Up & Clean-Up Services

Falling behind on your bookkeeping can be overwhelming, but SGM Bookkeeping is here to help you get back on track. Our bookkeeping catch-up and clean-up services are designed to bring your financial records up to date and ensure they are accurate and organized. By restoring order to your financial data, we help you regain control of your business's finances and provide a clear, accurate picture of your financial health.

Whether you've fallen a few months behind or need to clean up years of neglected records, our expert team will handle it with efficiency and professionalism, setting you up for future success.

From Messy Books to Accurate Records

Initial Consultation: Meeting with the client to understand the scope of the backlog and the specific needs of the business.

Data Collection: Gathering all relevant financial documents such as bank statements, credit card statements, invoices, receipts, payroll records, and any existing financial reports.

Review Existing Records: Analyzing the current state of the financial records to identify missing transactions, discrepancies, and errors.

Transaction Entry: Entering all missing transactions into the accounting system, ensuring each is recorded accurately with the correct dates and amounts.

Bank Reconciliation: Reconciling all bank accounts by comparing the bank statements with the transactions recorded in the accounting system, identifying, and resolving any discrepancies.

Credit Card Reconciliation: Reconciling credit card statements with recorded expenses to ensure all charges and payments are accounted for.

Catch-Up Services Include

Accounts Receivable Review: Reviewing outstanding customer invoices, recording any received payments, and updating the accounts receivable ledger.

Accounts Payable Review: Reviewing vendor bills and payments, ensuring all expenses are recorded, and updating the accounts payable ledger.

Expense Categorization: Categorizing all expenses accurately to facilitate detailed financial reporting and analysis.

Payroll Reconciliation: Verifying payroll records, including wages, tax withholdings, and deductions, and entering any missing payroll transactions.

Ledger Adjustments: Making necessary adjustments to the general ledger to correct any errors or inconsistencies.

Final Review and Reporting: Conducting a final review of the updated financial records and providing a detailed report summarizing the work completed and the current financial position.

Don't let disorganized books hold you back—get started with

our clean-up and catch-up services today!

Excellent Work Ethics!

”An amazing and caring person, Suzanne walked into a messy book setup, was able to clean up the books, and resumed bookkeeping assistance for the company. She prepared for the tax season and brought our business into a well-organized system. ”

- Patti

Clean-Up Services Include

Initial Assessment: Conducting a thorough review of the current financial records to identify discrepancies, errors, and areas needing attention.

Data Collection: Gathering all necessary financial documents, such as bank statements, credit card statements, invoices, receipts, payroll records, and prior financial reports.

Transaction Verification: Checking and verifying recorded transactions for accuracy and completeness, ensuring all transactions are properly documented.

Duplicate Entry Removal: Identifying and removing any duplicate transactions in the accounting system.

Expense Categorization: Re-categorizing expenses to ensure they are accurately classified according to the business’s accounting standards.

Bank Reconciliation: Reconciling all bank accounts by matching the bank statements with the transactions recorded in the accounting system and resolving any discrepancies.

Credit Card Reconciliation: Reconciling credit card statements with the recorded transactions to ensure all charges and payments are accounted for accurately.

Accounts Receivable Clean-Up: Reviewing and updating accounts receivable records, ensuring all customer invoices are recorded and payments are accurately tracked.

Accounts Payable Clean-Up: Reviewing and updating accounts payable records, ensuring all vendor bills are recorded and payments are accurately tracked.

Ledger Adjustments: Making necessary adjustments to the general ledger to correct any errors or misclassifications.

Payroll Reconciliation: Verifying and correcting payroll records, including wages, tax withholdings, and deductions.

Inventory Reconciliation: Reviewing and updating inventory records to match physical counts and correcting any discrepancies (if applicable).

Historical Data Correction: Reviewing and correcting historical financial data to ensure consistency and accuracy across all accounting periods.

Financial Statement Review: Generating and reviewing updated financial statements, including income statements, balance sheets, and cash flow statements, to reflect the corrected data.

Tax Compliance Check: Ensuring all tax-related entries are accurate and that the business is prepared for any upcoming tax filings.

Client Communication: Providing regular updates to the client on the progress of the clean-up process and discussing any significant findings.

Final Review and Reporting: Conducting a final review of the cleaned-up financial records and providing a detailed report summarizing the work completed and the current financial status.

Payroll Made Easy: Let Us Handle the Details

SGM Bookkeeping handles all aspects of payroll processing, from calculating wages and tax withholdings to managing benefits and deductions, ensuring that your employees are paid correctly and on time.

This not only improves employee satisfaction but also saves you valuable time and resources.